Financial Distress in the US E&P Space

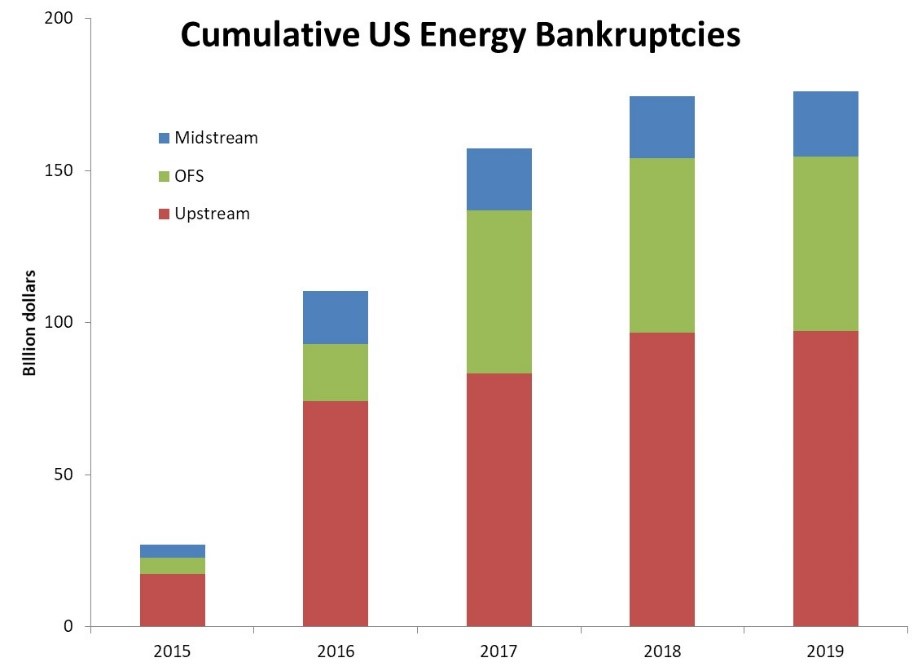

I read an interesting article today on Hart Energy’s website titled US Shale Producers Could Face Another Bankruptcy Wave. It’s an interview with Paul Jansen, managing director of Conway MacKenzie about a potential wave of bankruptcies in the E&P space. He posits that lower production driven by the industry trying to meet investors’ laser focus on the bottom line might result in financial distress for more leveraged companies. Of course, bringing up what happened in 2015-2017 isn’t polite at Houston, Dallas or Denver dinner parties. Adding the midstream and oil field services bankruptcies to upstream, these total $176 billion of equity value destroyed between 2015 and today:

Source: Haynes and Boone, LLP, Oil Patch Bankruptcy Monitor, Oilfield Services Bankruptcy Tracker, Midstream Report, all May 16, 2019

The author discusses how mergers might help E&Ps in a challenging situation. What occurred to me as I read the article is that cost reduction should be a key focus now as well. Let me give you a few examples. Recently a large E&P company began delving into areas where cost increases had become a problem. For them, it was Land Administration. Their analysts were spending an inordinate amount of time on tasks that were mostly research and rote data entry. The solution they found was Robotic Process Automation (RPA). After a 2 month engagement to map their most time consuming process and code the bots, they were able to deploy an RPA solution that carved 47 steps out of a 59 step manual process. This switch will deliver 8 figure savings over the next five years.

Another recent example that comes to mind is a medium-sized private E&P company that was plagued with an inefficient and occasionally insubordinate department in their back office. They looked at automation, but it wasn’t a fit because their scale wasn’t large enough for the investment. They looked at offshoring but were troubled by one of their executive’s bad experience at a major. Eventually they decided to outsource a component of their back office to a local firm. This enabled them to accomplish several goals: they exited a department that was underperforming, the work was being done locally so they felt they had more control than if it was offshored and it was all done at the right cost. The company projects they will save millions of dollars over the next six years, factoring in not just the lower cost of outsourcing but the reduced management time required to oversee poorly performing employees.

Both these examples highlight that E&P companies can find tremendous savings right inside their own operations. From automating manual processes to redesigning back office workstreams to digitizing and categorizing documents to outsourcing, E&P firms have a plethora of ways to reduce cost. Now is the time to act. If prices rise, focusing on these areas still matter as profitability can mask the impact of inefficiencies. Or, and this will really get you in trouble if you mention it at dinner parties, if energy prices go lower from here, not taking action on expenses today can have a serious impact tomorrow.

Brian Spector, Chief Development Officer – Sirius Solutions LLLP

If you would like further information to help you navigate Financial Distress in the US E&P Space, please complete the form below.

Error: Contact form not found.