Your Order-to-Cash Desired State

The clear purpose of great OTC processes goes beyond streamlining and gaining efficiency.

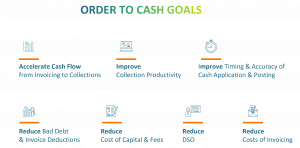

Order-to-Cash Goals

Your company should accelerate cash flow and contribute to your bottom line by reducing borrowed working capital and associated interest expense. I am certain you all have been in tune with inflation and are aware of rising interest rates.

If you can improve collections and post payments immediately, then Treasury will have a better cash forecast. The results support larger corporate decisions, reduce the cost of capital, and avoid P&L hits from bad debt reserves.

One will also improve DSO and the cost of invoicing. While DSO is dependent upon sales contract terms, it is a standard that is understood, measured, and reported by credit. With millions in collections, credit can bring DSO down and be a hero in your organization.

For our client, a large, publicly traded global manufacturer and marketer of differentiated and specialty chemicals, we reduced DSO from 52 to 43 days and improved working capital by $128 million over a few years. We partnered closely with the business to help influence customers when necessary. Our shared service team was respected, and they decreased the cost allocated to them. Sales included our management team in their customer meetings and saw our function as a competitive advantage.

Recommended Desired State

Your desired state will include digital data capture and electronic payments, API integration with your banks, and significant automation of matching payments. Credit can help Treasury and the business optimize A/R and A/P to align pay terms and reduce the cost of capital (short-term borrowings) with proper data analysis.

Today, you need REAL-TIME data, and it is now affordable. You want an infrastructure that you can quickly scale with growth without adding headcount. You also want to be able to support spin-offs. Your technology must be scalable to support future growth over years to come. The infrastructure should also be extendable, which means you should be able to extend your system with minimal effort to implement.

Sirius Solutions Order to Cash Service Offerings

Sirius Solutions is a professional services firm focused on improving the operational and financial performance of its clients. Founded in Houston in 1998, we have clients in 30+ industries and in 45+ countries around the world, and our leaders average 20 years of real-world subject matter expertise.

We engage in projects that both improve cash flow while simultaneously reducing costs. As well, we assist our clients in software selection, business readiness, and implementation/integration and have been deep in the trenches of risk management with some very prestigious firms (contact us for a list of clients). We have gained significant experience in crisis management, operational improvements, and technology solutions.

See our list of service offerings where we ensure that our clients gain a significant return on their investment with us:

- Accelerate Cash Flow from Commercial thru Field Operations from Invoicing to Collections

- Improving Collection Productivity

- Improving Timing and Accuracy of Cash Application and Posting

- Acquisition Integration – Day 1 Readiness Treasury / Accounting / Credit / Cash Flow Functions

- Reduction in Bad Debt & Invoice Deductions

- Reducing Cost of Capital and Fees

- Reducing DSO

- Reducing Costs of Invoicing

- Software Selections Costs Benefit Analysis / Economic Impact / Module & Functionality Evaluation

- Business Readiness – Workflow Re-design or Enhancement / Foundation Data Models to capture AI Value

- Software Implementation & Integrations with CRM, ERP, Billing, Credit, Banking Systems

- User Adoption & Effectiveness

Sirius Solutions can quickly and easily assist your organization with any type of financial digital transformation you may require.